Transactions from most Swiss banks can be uploaded to Atlanto. This article shows how to proceed if you have an account with Credit Suisse.

- Enter and Add Bank Account

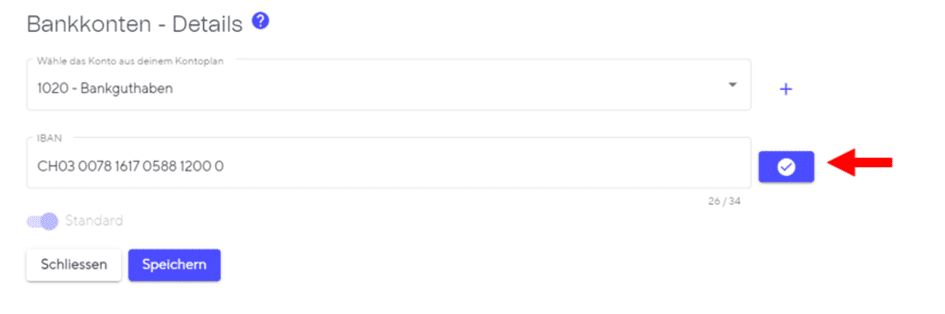

Enter your bank account info in the settings under Accounting – Bank/cash accounts. To this end, choose which account from your account plan you want to link to your bank account. Your bank transactions are then posted by default with this account. Do not forget to validate the captured account with the blue tick on the right. If not, the bank account cannot be saved.

- Download CAMT File from Credit Suisse E-Banking

The first step is to order the subscription needed to generate CAMT.053 V08 Detail files:

- Log in to CS E-Banking.

- Select the Accounts and Cards tab > Download Infaccount.

- Click on Order Subscription.

- Order the subscription in CAMT.053 V08 Detail format.

After you have gotten the subscription, you can download the CAMT files as follows:

- Log in to CS E-Banking.

- Select the Accounts and Cards tab > Download Infaccount.

- Select the desired account.

- Make sure that the CAMT.053 V08 Detail tab is selected.

- Under View Selection, choose between new files or files already transmitted.

Select the option New Files. If you export files that have already been transferred, there is a risk of double entries in Atlanto. - Click on the file name to download the file.

- The file can now be uploaded to Atlanto

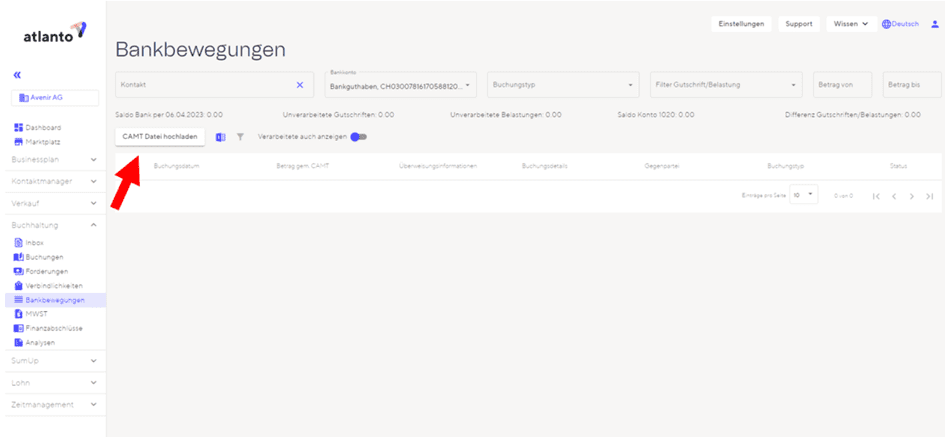

- Upload CAMT file to Atlanto

Once the CAMT file has been downloaded, go to bank movements in Atlanto. There, click on Upload CAMT file and either click and drop the file into the predefined window or select it directly under files. After that, all transactions contained in the CAMT file will be displayed in Atlanto and will be posted accordingly.