Atlanto does not currently calculate the tax at source automatically. This means that you have to get the rate yourself from the table of the cantonal tax administration. The amount must also be calculated manually. To do this, proceed as follows:

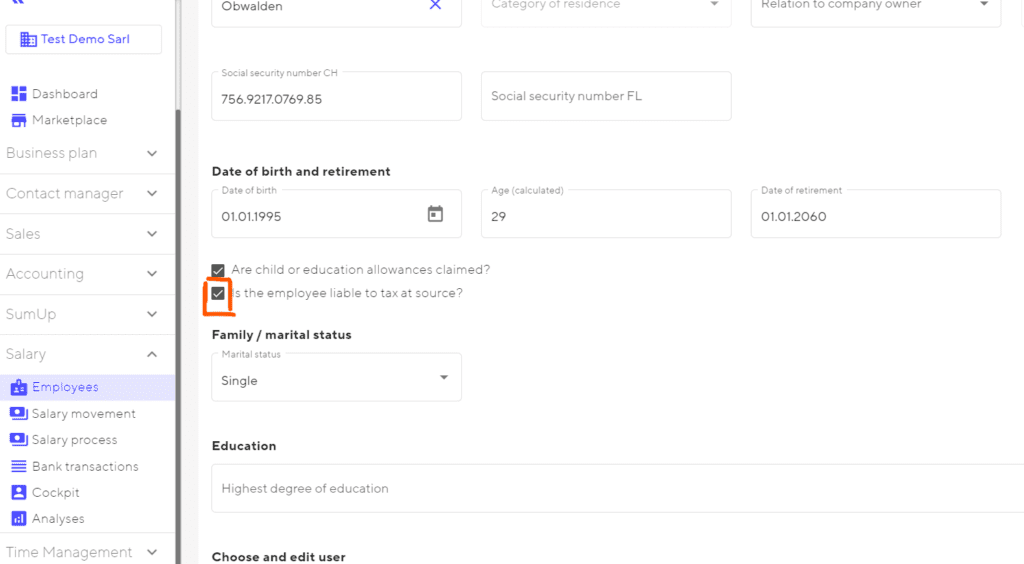

The first step is to tick the “Is the employee liable to tax at source?” box for the employee.

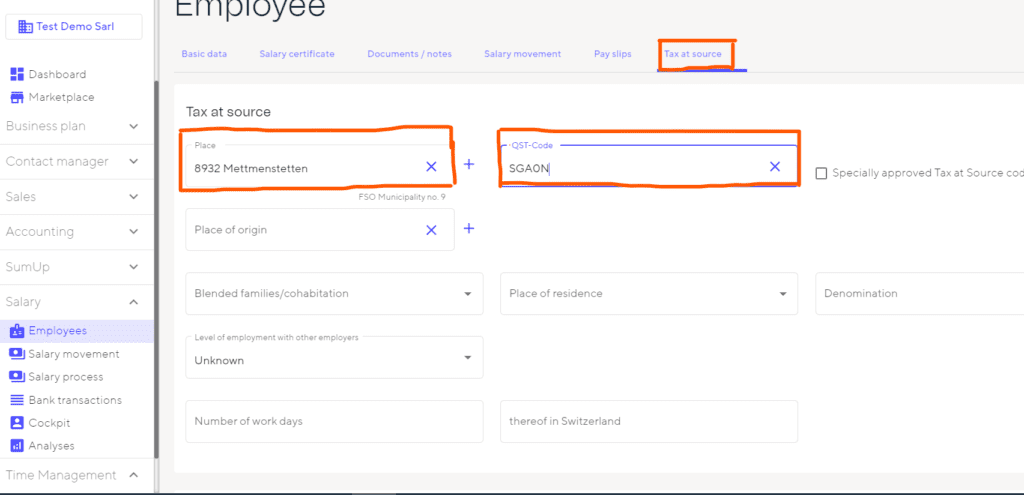

Then select the location and the corresponding rate (tax at source code) in the “Tax at source” tab.

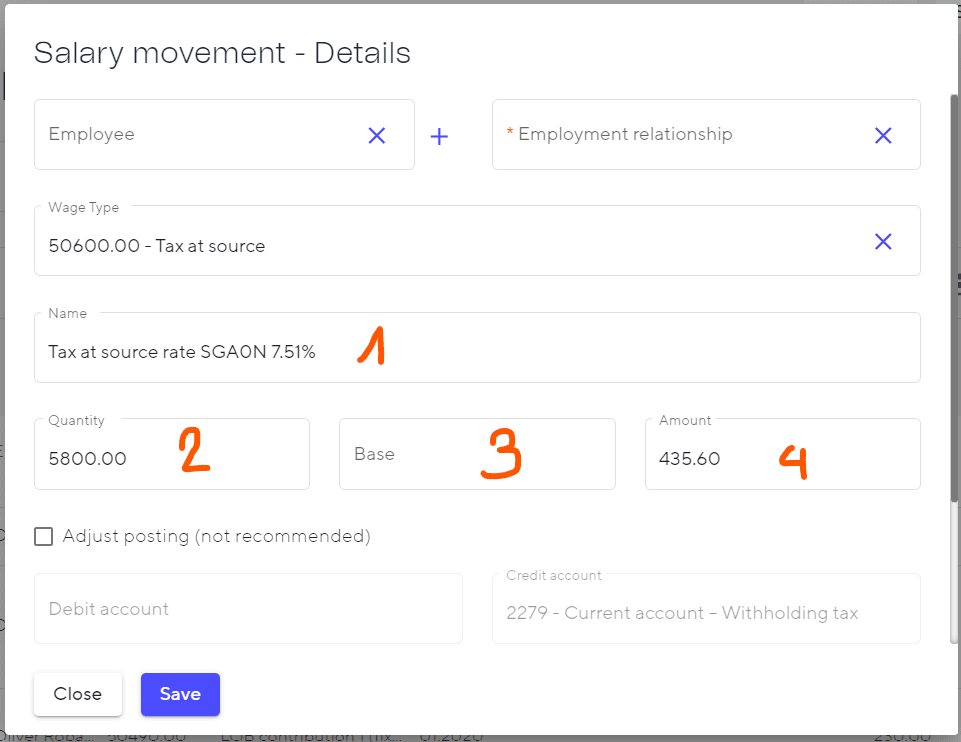

In the next step, add the salary movement “50600.00 Tax at source” manually. The name (1) can be freely chosen, e.g. mention the rate here. For the quantity (2), enter the basis on which the withholding tax is calculated. The base (3) is the rate and then (4) you enter the specific amount. Currently, the amount is not yet calculated according to the rate, but must be calculated manually.

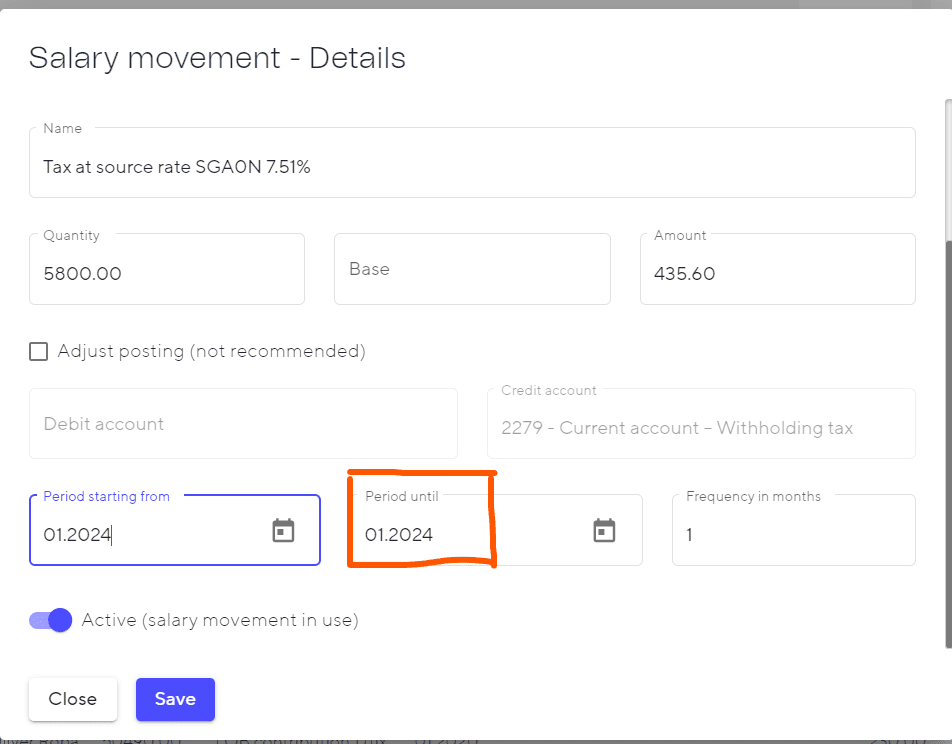

Important: If the gross salary changes (e.g. in the month of payment of the 13th month’s salary or in the event of a possible deduction due to accident / illness), the rate will change. This means that the rate for the month in question must be searched for manually in the cantonal tax administration table and a new salary movement must be created. To do this, we recommend cancelling the old tax at source payroll and creating a new one. If the rate only applies for one month and then the old rate applies again, the end date must be set for the new salary movement and a new movement must be added for the following months.