The financial year is coming to an end, and it is once again time for… the annual financial statements. There is no getting around it, for most companies it is mandatory. Most people like to write it about as much as they like to fill in their tax forms. Do not panic, we will help you and explain how it works with as little blah-blah as possible.

Financial Statement, What Is That?

The annual financial statement is the closing of the commercial financial year. The commercial what? Simply put: The end of the tax period (as often referred to in Switzerland). It presents the financial situation and the economic success of your company so that outsiders can get a clear and transparent picture of your company’s standing.

What are outsiders? Here we mean potential investors, shareholders, and banks, but also authorities and others, who might want to analyse your financial statements in order to decide, for example, on a possible investment in your company. Sounds good, does it not?

The purpose of a financial statement is to present the economic situation and the success of your company truthfully, allowing third parties, but also you, to get an accurate and reliable picture of the financial situation of your company.

Fact: Tax periods are not equal to years. Even though for many companies the financial year roughly corresponds to one calendar year (01.01 to 31.12), there are also 6-month tax periods (01.01 to 01.06, 01.07 to 01.12). In special cases, you can also apply for an extended financial year. For example, if you started your business in November 2023, then it makes no sense to close your financial year after 2 months. Instead, you can apply for an extended tax period and the last months of 2023 can be added to 2024.

Is It Necessary to Write a Financial Statement?

First question: Do you have a sole proprietorship and is your annual turnover less than CHF 500,000? Good news! Then, according to the Swiss Code of Obligations (Art. 957 para. 2 CO), you are exempt from filing a financial statement.

Do you have a sole proprietorship with an annual turnover of more than 500,000, an SA or SARL with an obligation to double-entry accounting? There is good news for you too! You may be obliged to prepare annual financial statements and share information with shareholders (Art. 696 para. 1 CO), but you have Atlanto – we will explain what to do in a few easy steps.

What Should My Financial Statement Contain?

You will need at least the following three documents for your financial statements:

- The balance sheet: Lists your assets and liabilities, as well as your payroll accounting.

- The profit and loss report (income statement): This is a report of all your accounts that have an influence on your annual result, e.g. turnover, depreciation, taxes, etc. Which accounts are shown here depends on your chart of accounts.

- Annex: In addition to the typical “admin stuff”, such as your company name, address, date of foundation, description of your company, etc., explanations for the two documents mentioned above (balance sheet and income statement) are also required. Find out what else you specifically need to add in Art 96a OR & Art 961d Abs. 1 OR.

How Do I Prepare a Financial Statement?

When preparing financial statements, you have two options (unless you’re an accounting professional, but then you probably would not be reading this blog).

1. Your accountant does it for you

If you are not familiar with accounting, a professional will be able to help you to keep your accounts and prepare your financial statement, amongst other things.

For these professionals in accounting, annual financial statements are child’s play. You do not have an accountant yet? We work with selected accountants from all over Switzerland, find one near you here.

If you choose this option, make sure you prepare all the necessary documents (receipts, invoices, etc.) for your accountant.

However, if you want to save time and money, we recommend using accounting software such as Atlanto – there you can easily give your accountant access so that they can keep your accounts directly in the software and also prepare your financial statement easily. Is that really possible? Of course! We will explain everything in the next sub-chapter.

2. Use an accounting software

An accounting software usually allows you to create your financial statements automatically along with the most important documents (balance sheet and profit and loss account).

In addition, working with a software simplifies your everyday life. It allows you to upload all your receipts, invoices, incoming payments, bills, expense reports, etc. and then easily post them, so you avoid paperwork and save time!

If you work with an accountant, you will save time and money, as your accountant can now do all of their work in the software.

Interested? Then read on and see what an annual financial statement looks like with our step-by-step guide.

Create a Financial Statement With Atlanto

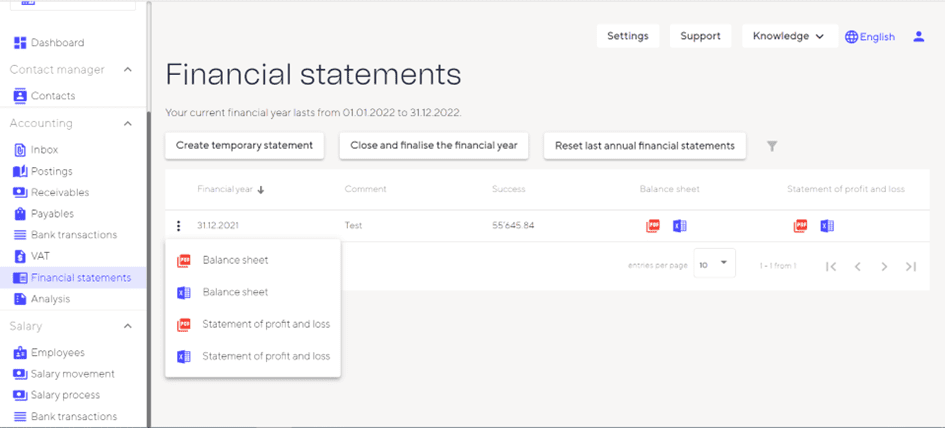

You can easily create your financial statement in Atlanto and thus close your financial year. Find step-by-step instructions below.

Attention: Closing your financial year also closes your accounting. Therefore, you need to make sure all the bookings for your financial year are ready before you go ahead with the closure.

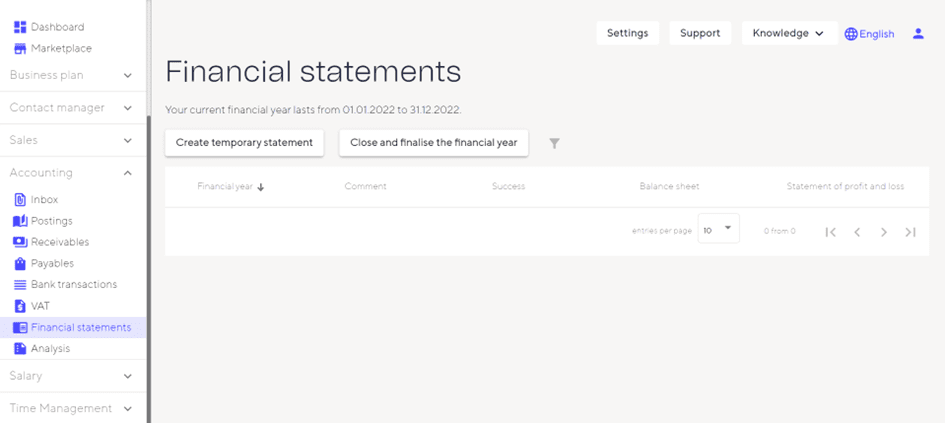

Step 1: Create your annual financial statement under the heading Accounting then Financial Statements with the function Close and finalise the financial year.

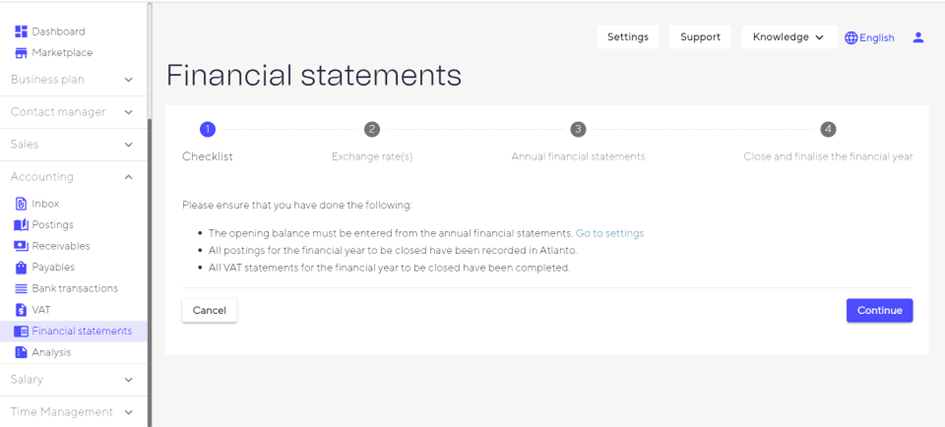

Step 2: Our checklist guides you through the different stages

Stage 1

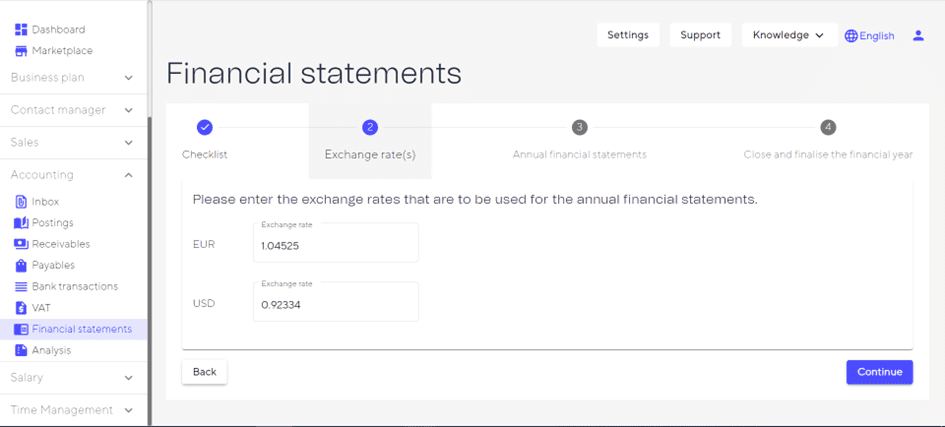

Stage 2

The predefined exchange rate is that of the cut-off date of your financial statement (in this case 31.01.2023).

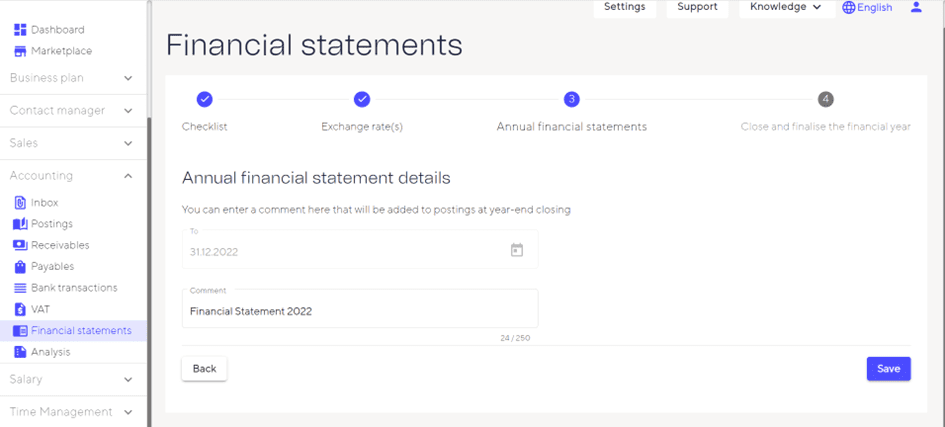

Stage 3:

Add a note such as “Financial Statement 2023”.

Stage 4

Just wait a little while longer until your statement is ready.

Step 3: Download your financial statement in PDF or Excel format.

Do you need more help? Do you have other questions about Atlanto? Then visit our free introductory course to Atlanto to learn everything you need to know.