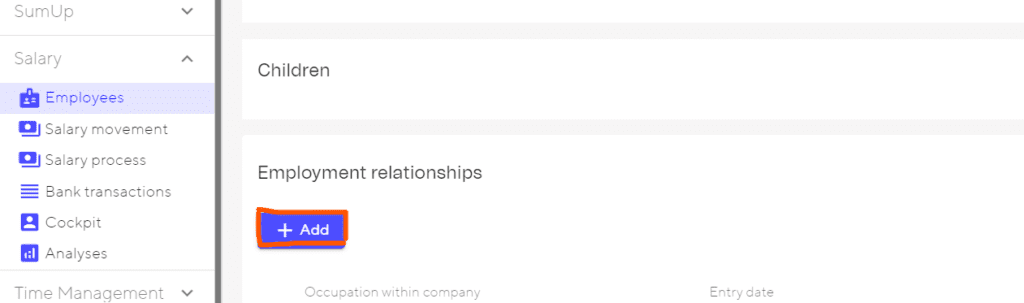

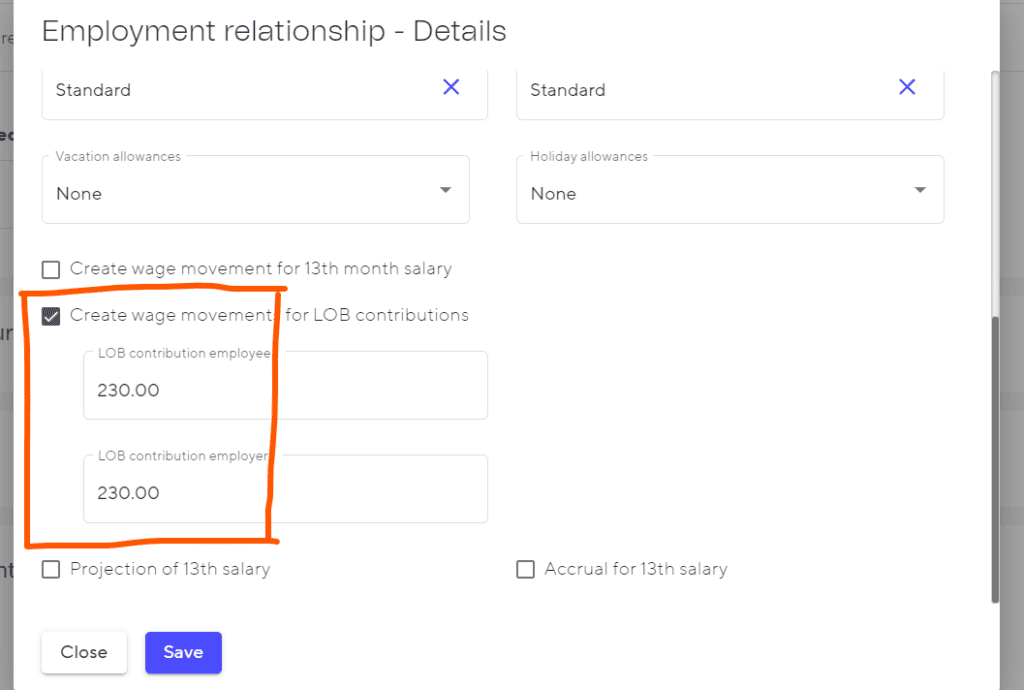

In the vast majority of cases, the LOB contribution is a fixed amount and not a specific percentage rate as in the case of KTG or LAI. The LOB contribution is therefore entered separately for each employee. If you enter a new employee, you can enter the amount for the employment relationship.

To ensure that the salary movements (employer and employee) are created automatically, tick the box “Create salary movements for LOB contributions”. You can then enter the employer and employee contributions.

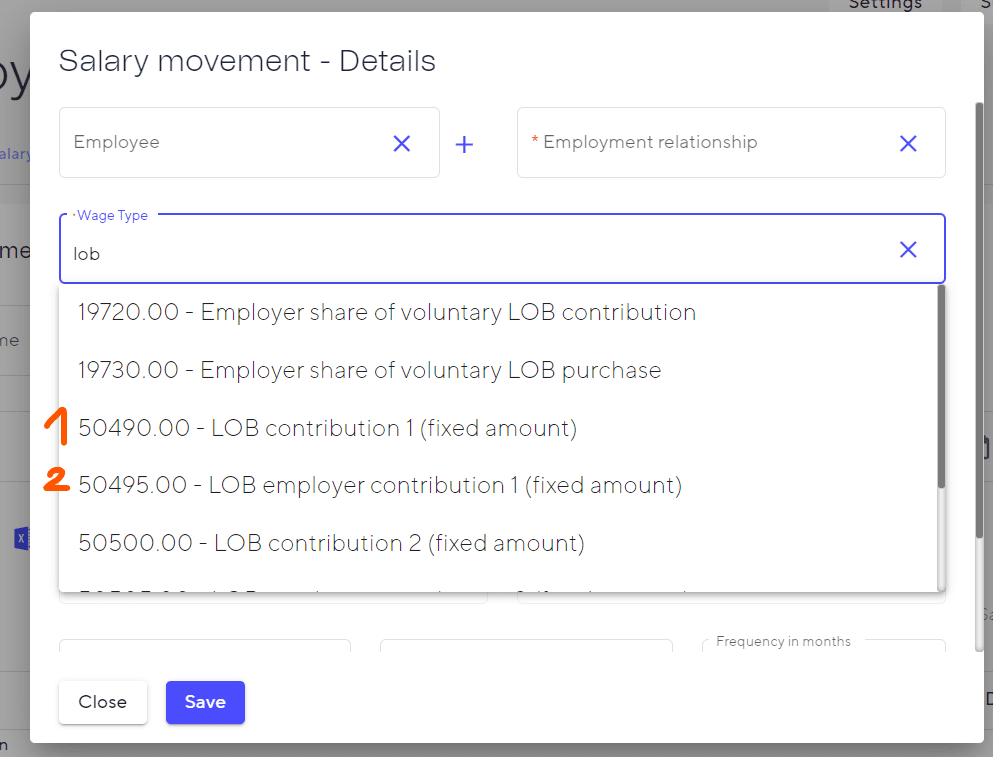

Alternatively, you can also add the two salary movements manually. To do this, go to the employee under “Salary movements” and add the two wage types “50490.00 – LOB contribution 1 (fixed amount)” and “50495.00 – LOB employer contribution 1 (fixed amount)”. The first wage type is for the employee contribution and the second wage type is for the employer contribution.

If the LOB contribution needs to be adjusted, the amount can be adjusted directly in these wage movements.