Introduction

As a result of the vote on the Federal Decree on Additional Funding for OASI Pensions by increasing the Rate of VAT on 25 September 2022, an increase in VAT will take effect on 1 January 2024.

This guide aims to show how this impacts VAT rates and service provision. It further shows what changes and new features need to be considered when using Atlanto so that invoices are issued with the proper VAT rates and invoices / expenses are posted correctly.

Hereafter we will focus on how to handle these changes within Atlanto. Detailed information on the amendment can be found in the following two sources from the Federal Tax Administration:

- FTA VAT Info 19: VAT web publications (admin.ch) (German)

New VAT Rates 1 January 2024

The following tax rates will apply from 1 January 2024:

| Current | New | |

| Standard Rate | 7.7% | 8.1% |

| Reduced Rate | 2.5% | 2.6% |

| Special Rate for Accommodation Services | 3.7% | 3.8% |

The net tax rates will be adjusted as follows:

| Net Tax Rates until 31 December 2023 | Net Tax Rates from 1 January 2024 |

| 0.1% | 0.1% |

| 0.6% | 0.6% |

| 1.2% | 1.3% |

| 2.0% | 2.1% |

| 2.8% | 2.0% |

| 3.5% | 3.7% |

| 4.3% | 4.5% |

| 5.1% | 5.3% |

| 5.9% | 6.2% |

| 6.5% | 6.8% |

Time of Service Provision as a Benchmark for the Applicable Tax Rate

The applicable tax rate is determined neither by the date of invoicing nor the date of payment, but by the date on which the service is provided (Art. 115 para. 1 VAT Act). In the case of periodic services (e.g. subscriptions), the period of service provision is decisive. Services provided up to 31 December 2023 are subject to the previous tax rates. Services provided on and after 1 January 2024 will be subject to the new tax rates.

If a service is provided in a period subject to both the previous and the new tax rates, the period must be split into two, with the previous and new tax rates respectively. The two halves can be included in the same invoice. Invoices for services subject to the new tax rates must be settled using the new rates. The correct allocation of the supplies to the previous and the new tax rate can also be done in another way (Art. 81 para. 3 VAT Act).

Conversion of VAT Rates in Atlanto

The following chapter deals with the adjustments in Atlanto to account for both VAT and input tax at the correct rates.

Conversion of VAT Rates in Atlanto

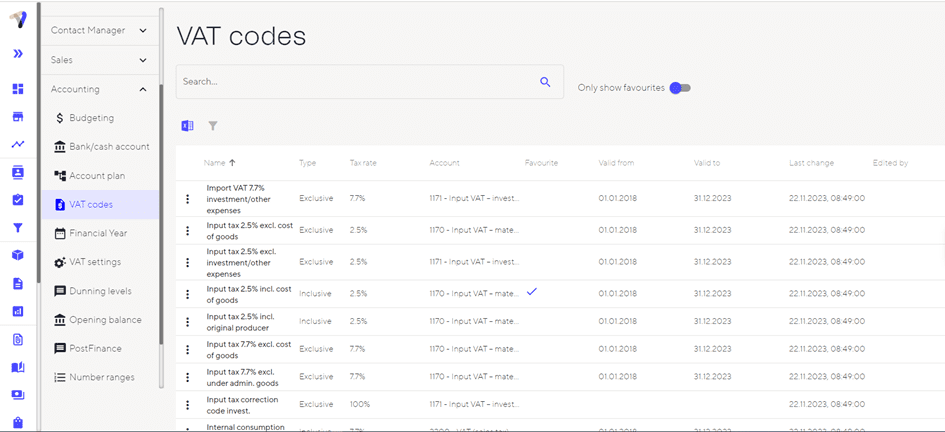

The new VAT rates are automatically imported into Atlanto, meaning no customisation by the user is necessary. All VAT rates that could apply to the respective postings are shown under the accounting settings:

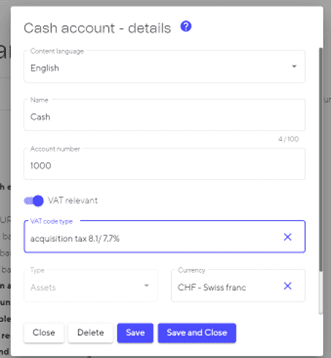

Effects on the VAT Rates Stored in the Chart of Accounts

In Atlanto chart of accounts, VAT rates can be saved for each account. When an account is selected for a posting, the right rate is automatically proposed. The new rates will be updated automatically. Depending on whether the posting is made in 2023 or 2024, the old or new rates will be proposed. These can then be changed manually.

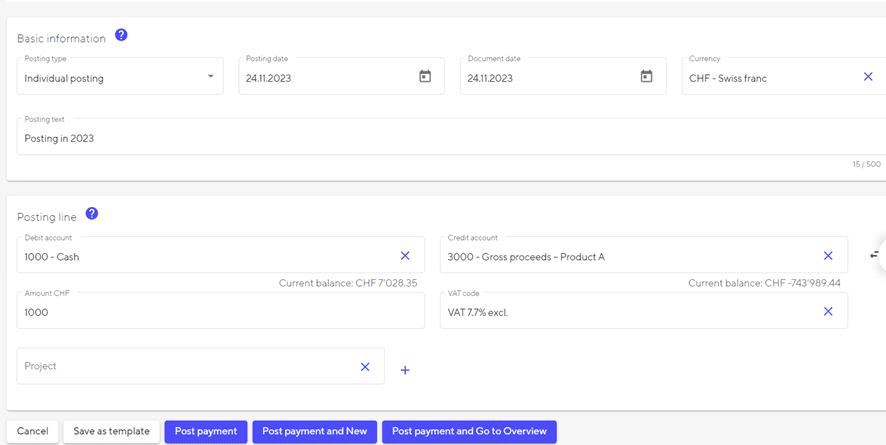

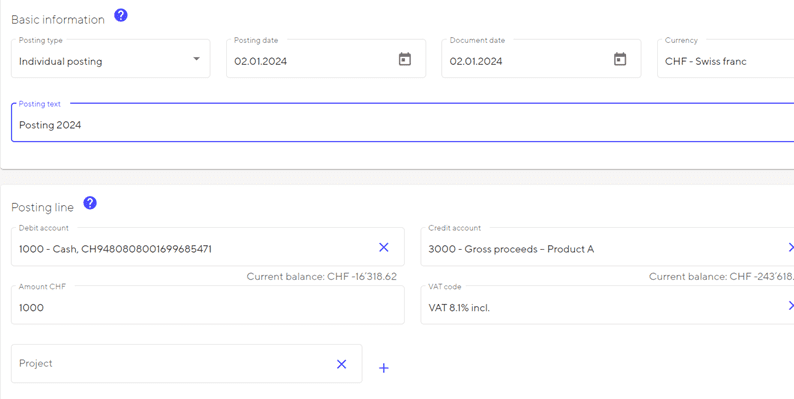

Example (both new and old VAT rate are shown):

Posting in 2023 (old VAT rate is automatically inserted):

Posting in 2024 (new VAT rate is automatically inserted):

Determine the Validity Period of the Old or New VAT Rates

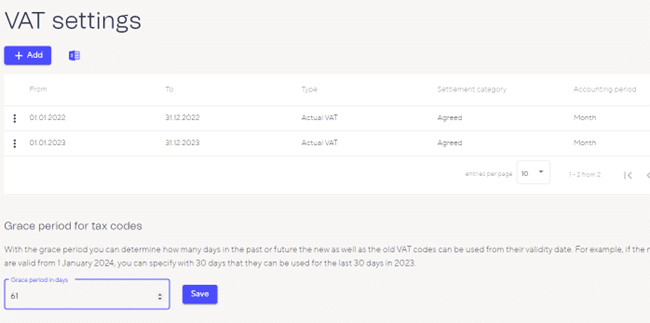

In some cases, services for 2024 will already be invoiced in 2023, in which case the new VAT rates will apply. To do this, you must specify in the settings how many days in the past or future the respective rates are valid (grace period).

Here are two examples:

Assuming you want to issue an invoice on 1 November 2023 with the new VAT rate, the grace period must be 30 days.

If an invoice with an old VAT rate is invoiced on 1 March 2024, the grace period must be 61 days.

This grace period can be defined in the accounting settings under VAT settings:

Effect on the VAT Rates Stored for Products

For each product a revenue account can be chosen. When invoicing, the saved VAT rate for the corresponding revenue account is suggested. If the invoice is created in 2023, the old VAT rate is automatically proposed. The new VAT rate will be applied to invoices issued in 2024.

Add VAT Period

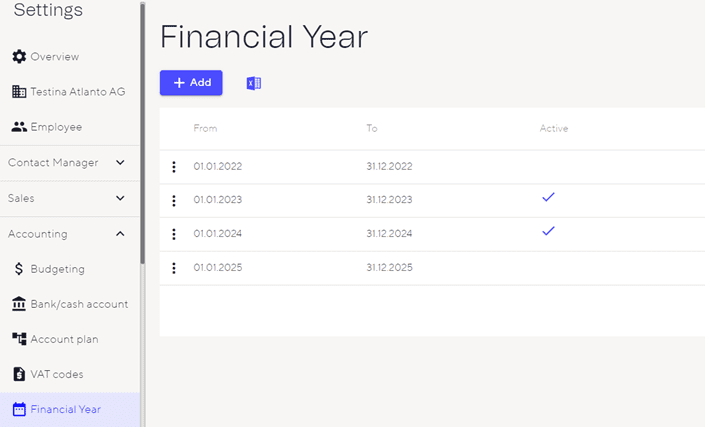

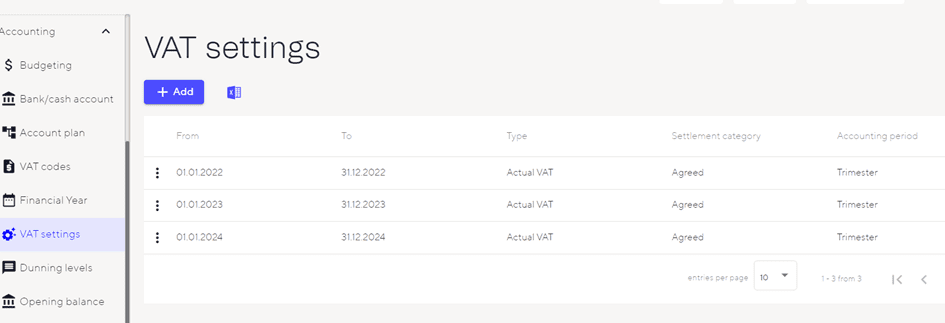

In order for postings to be made in 2024, it is important that both the financial year for 2024 and the VAT period are opened in the settings.

Financial Year:

VAT period:

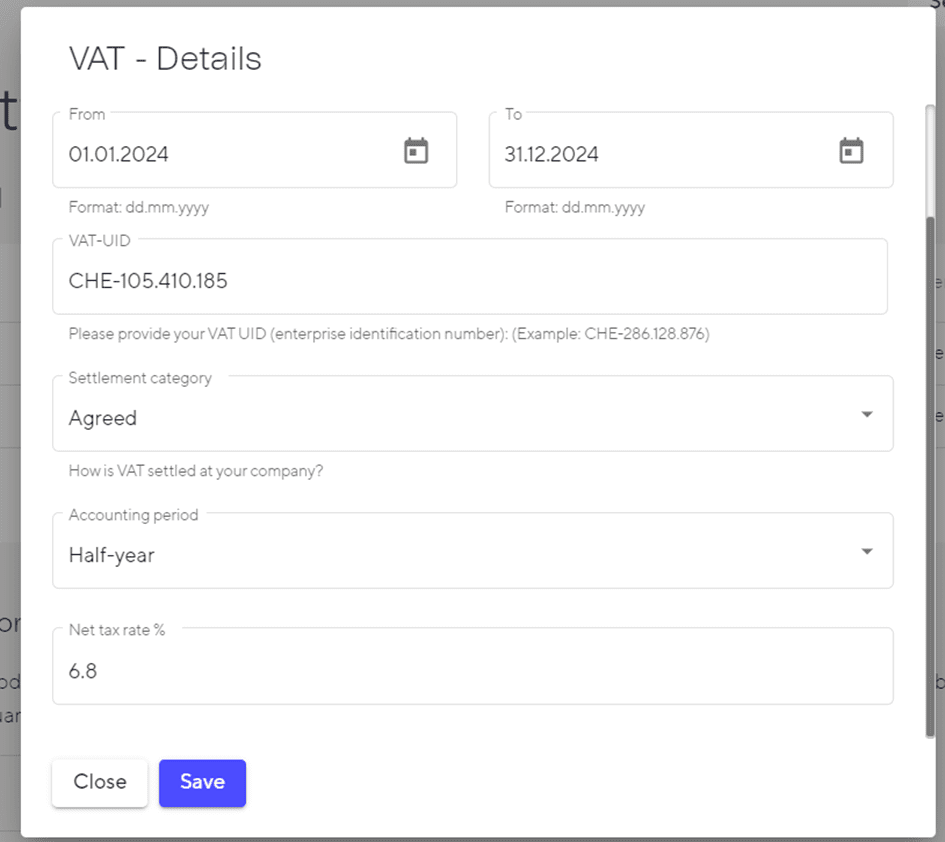

Special Feature Net Tax Rate

For the net tax rate, it is important that the adjusted rate is saved for the new VAT period. See the table above with changed VAT rates:

Furthermore, with the net tax rate method, it must be taken into account that invoices issued in 2024 will have the new VAT rate on the invoice (e.g. 8.1%). It is therefore also advisable to issue two invoices for the net tax rate (one for 2023 and one for 2024).

The input tax is not relevant for the net tax rate method, as only turnover is taxed.

Mapping of Individual Business Cases in Atlanto

The following chapter lists various business cases (e.g., writing invoices, posting invoices received, rent/subscriptions) and provides specific recommendations on how to use Atlanto.

Invoicing Customers

When an invoice is created in the Sales module, the document date (invoice date) determines which VAT rate is shown. If services were rendered in 2023, the invoice should also be issued in 2023. For services in 2024, the invoice should also be issued in 2024.

In the case of multi-year services (e.g. subscriptions, projects that extend beyond the year), we recommend issuing two invoices. This means that an invoice will be issued for the services in 2023 using the old VAT rates and then a separate invoice will be issued for the services in 2024 using the new VAT rates.

Should invoices be issued for more than one year, both the new and the old VAT codes for individual products can be selected and invoiced.

Copying Invoices

Within the Sales module, it is possible to create copies of invoices. The original document date (invoice date) is transferred to the copy. If this is in 2024, the new VAT rates are automatically applied. If it is still in 2023, the old VAT rates will remain.

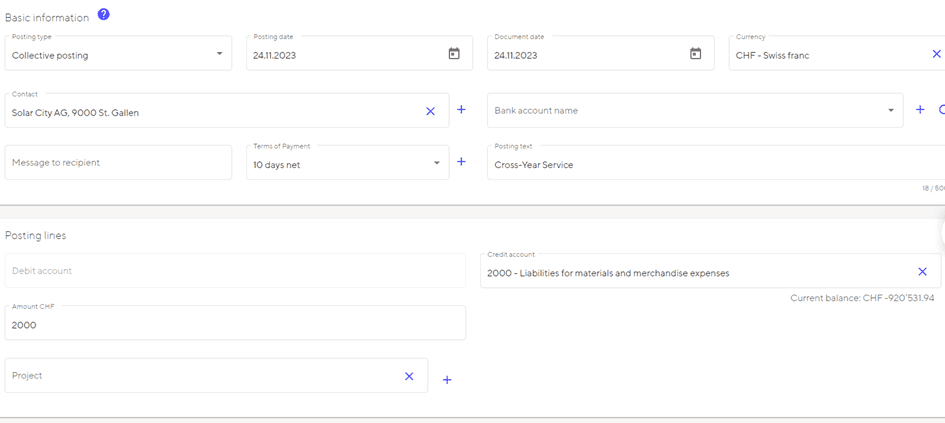

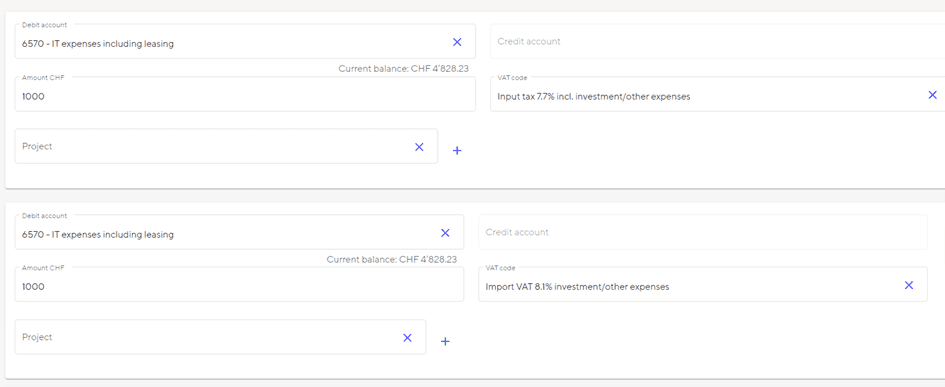

Invoice Received from Suppliers with Two VAT Rates

It is possible that invoices from suppliers (e.g. Microsoft licence fees, antivirus programs, newspapers) that contain cross-year services will be sent in the 3rd quarter of 2023. In this case, the services from 2024 must already be reported at the new VAT rates.

In Atlanto, a collective posting is to be made in this case, which separates the liability into a part for 2023 and 2024. This could look as follows:

It is important to note that this separation is not done automatically. Even after the introduction of the new VAT rates, the services would have to be deferred for the year 2024.

Invoices Received from Suppliers with New VAT Rate in 2023

In this case, the VAT rate must also be adjusted for the posting and the new rate selected instead of the old one. Separation is analogous to the case described above.

Invoices Received from Suppliers with the Old VAT Rate in 2024

In this case, the VAT rate must also be adjusted for the posting and the old rate must be selected instead of the new one. Separation is analogous to the case described above.

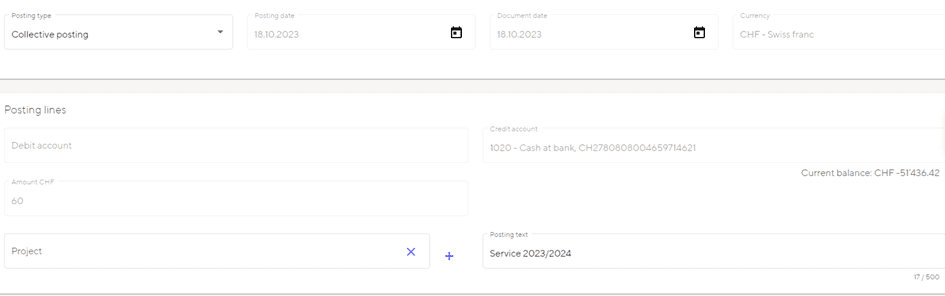

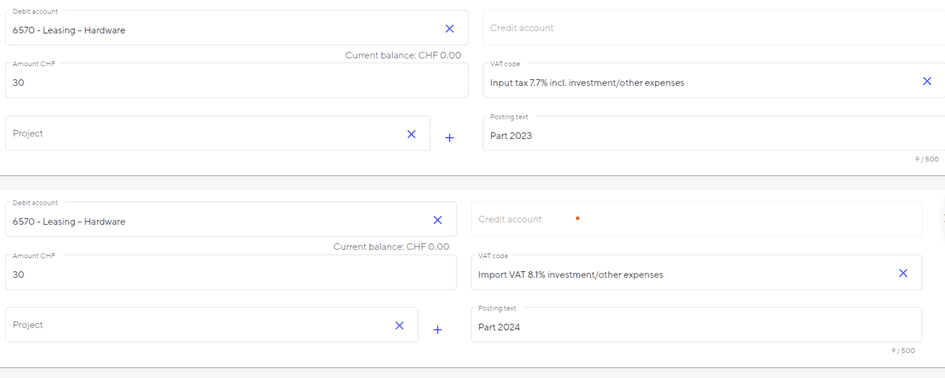

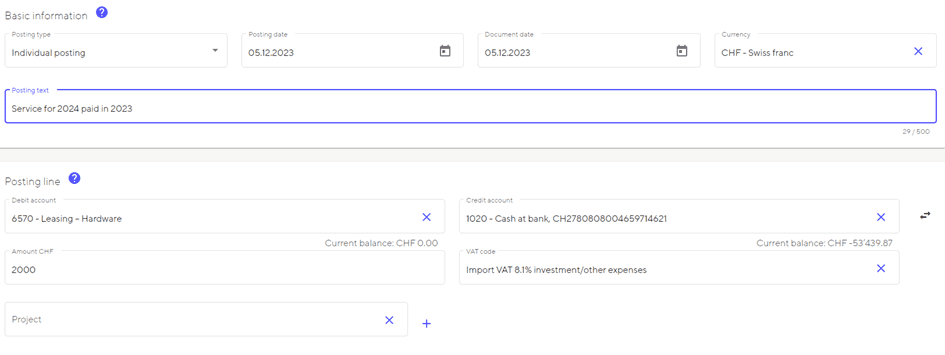

Manual Postings or Postings via Bank Transactions

In cases where no open item accounting is kept for liabilities, the postings are either made manually or are posted directly from bank transactions.

If the payment was made in 2023, the system will automatically propose the old VAT rates. However, if the invoices contain either two VAT rates or only the new VAT rate, the VAT code must be changed, either to a collective posting or a single posting:

Collective posting:

Single posting:

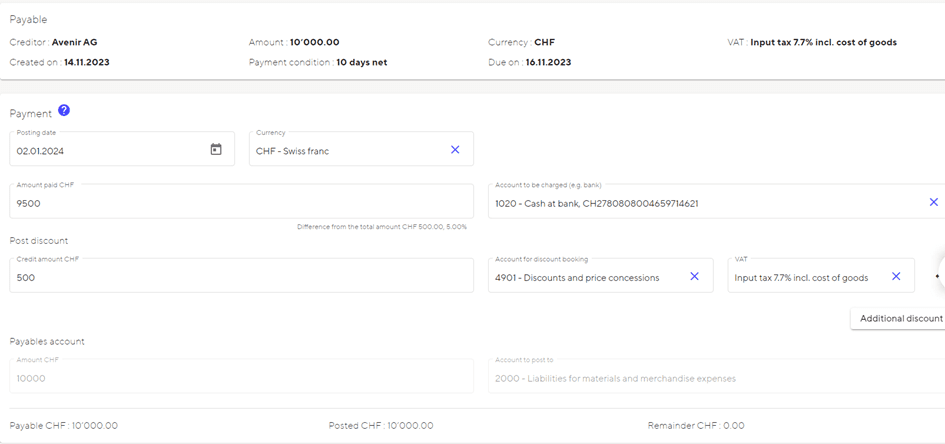

Reductions in Price / Discounts

Reductions in price (discounts, rebates, complaints or losses) for services from 2023 must be corrected using the previous tax rate.

In Atlanto, this can be done when the payment is posted or subsequently by means of manual posting.

Posting of the payment:

Payroll

If expenses are paid out, input tax deductions may also be made. In this case, the posting date is relevant. If expenses are paid out in 2024 for the year 2023, the new VAT rate must be replaced by the old one.

Preparation of VAT Statements

The new VAT form can be created for the first time from the 3rd quarter of 2023. In this case, the services invoiced at the old rate are shown in a separate column and the services invoiced at the new VAT rate are shown in the columns valid from 1 January 2024.

Support

If you have any questions or queries, please contact our customer support team.