To adjust the payable or receivable, you must ensure the following:

1. The final VAT statement has been reset

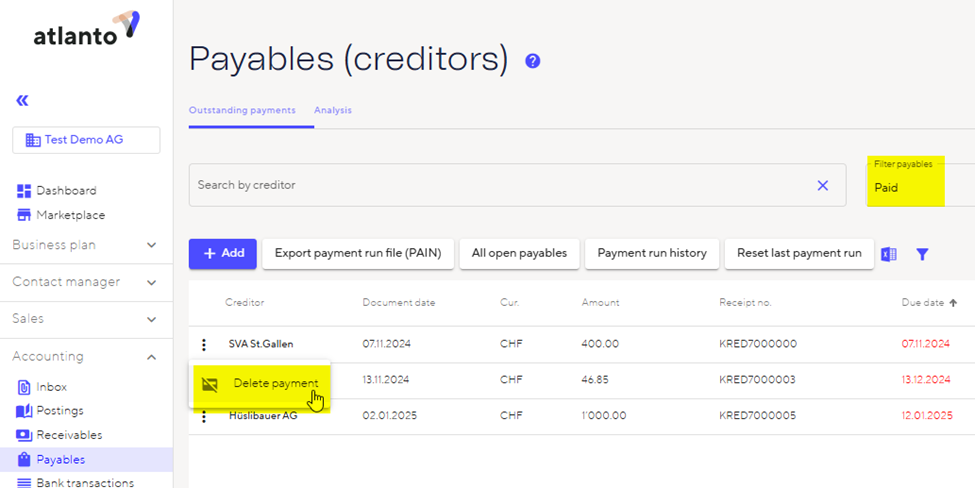

2. Payments have been deleted (not necessary if agreed): To do this, go to Receivables or Payables, click on the three dots to the left of the payable/receivable and then “delete payment.”

3. Please note:

– For manually posted payments, you must remember/note the payment date.

– If you settled the payable or receivable via bank transactions, the bank transaction will be displayed again after the payment has been deleted and you can then make the postings again via bank transactions after the adjustment.

– We have to delete partial payments for you; you cannot delete them yourself. Please contact us if this is the case.

4. You can now adjust the payables or receivables.

5. If it is a receivable that was created via sales/documents, you must reset the invoice to “draft” status, which will then allow you to adjust it.