Adjust UVG and KTG

Social security rates may change, especially at the turn of the year. Therefore, please make sure to review your policies, as changes often occur in the UVG.

You have two options for adjusting the KTG or UVG rate.

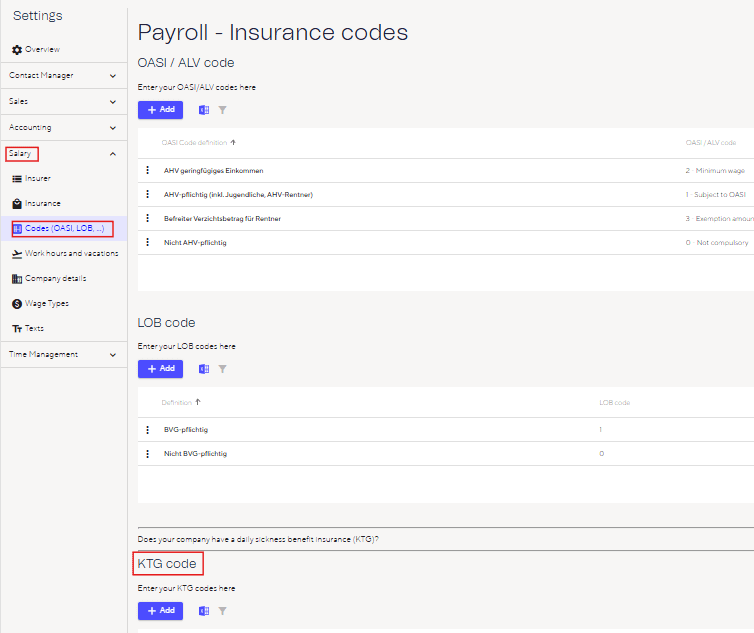

Option 1: Create a new code

You can create a new code for the new year. To do this, go to Settings – Payroll – Codes and add a new code with the new rate.

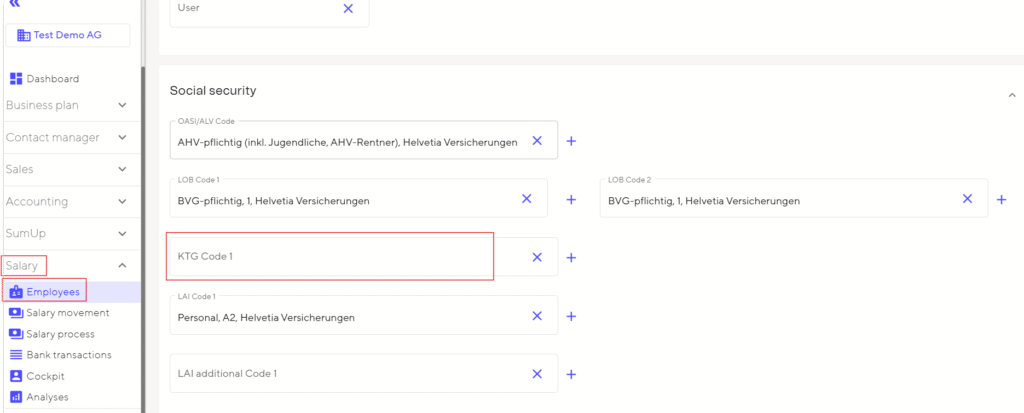

With this option, you must then select the new code for each employee.

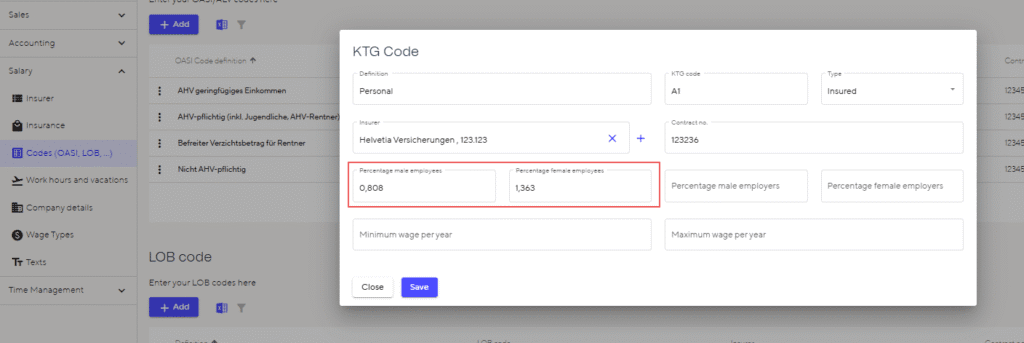

Option 2: Overwrite the code

You can simply overwrite the existing code with the new set. The advantage of this is that you do not have to select the new code for each employee. The disadvantage of this solution is that you have less overview of past payments.

Important: Only do this this after you have completed the December salary process and before you start the January salary process.